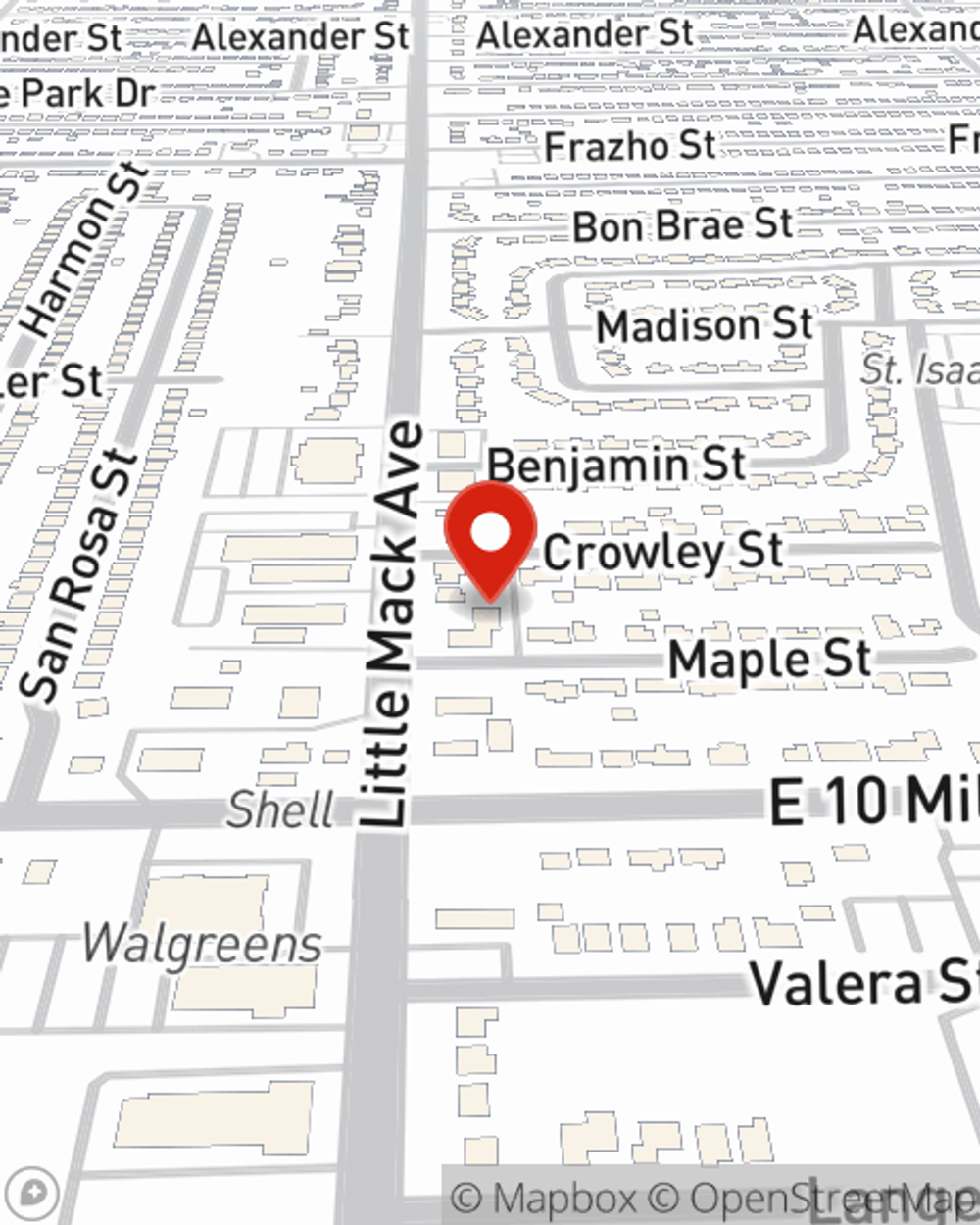

Business Insurance in and around St Clair Shores

One of St Clair Shores’s top choices for small business insurance.

Helping insure businesses can be the neighborly thing to do

Help Protect Your Business With State Farm.

Small business owners like you have a lot of responsibility. From financial whiz to tech support, you do everything you can each day to make your business a success. Are you a painter, an electrician or a plumber? Do you own a pottery shop, a tailoring service or an antique store? Whatever you do, State Farm may have small business insurance to cover it.

One of St Clair Shores’s top choices for small business insurance.

Helping insure businesses can be the neighborly thing to do

Get Down To Business With State Farm

The passion you have to contribute to your community is a great foundation. When you add business insurance from State Farm, you can be ready for the challenges ahead. That’s why entrepreneurs and business owners turn to State Farm Agent Tom Peck. With an agent like Tom Peck, your coverage can include great options, such as commercial auto, commercial liability umbrella policies and worker’s compensation.

As a small business owner as well, agent Tom Peck understands that there is a lot on your plate. Reach out to Tom Peck today to talk over your options.

Simple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.

Tom Peck

State Farm® Insurance AgentSimple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.